Since 2021, GameStop has been undergoing a transformation: new leadership, fewer stores, higher value, renewed profitability.

GameStop went from a situation where it was losing hundreds of millions of dollars per year, facing real risk of bankruptcy, to now having the highest stockholders' equity in company history, operational profitability, and on track for its most profitable year ever.

Pre-turnaround FY 2020 | Current Status TTM, as of December 2025 | |

| Store Count | 4,816 | 3,203 |

| Revenue | $5.1B | $3.8B |

| Operating Income | -$237M | $177M |

| Interest Income | -$32M | $241M |

| Net Income | -$215M | $422M |

| Earnings Per Share | -$3.31 | $0.94 |

| Stockholders' Equity | $0.4B | $5.3B |

| Book Value Per Share | $6.72 | $11.84 |

Explore the history of GameStop and see noteworthy events in their relationship to the changes of GME stock

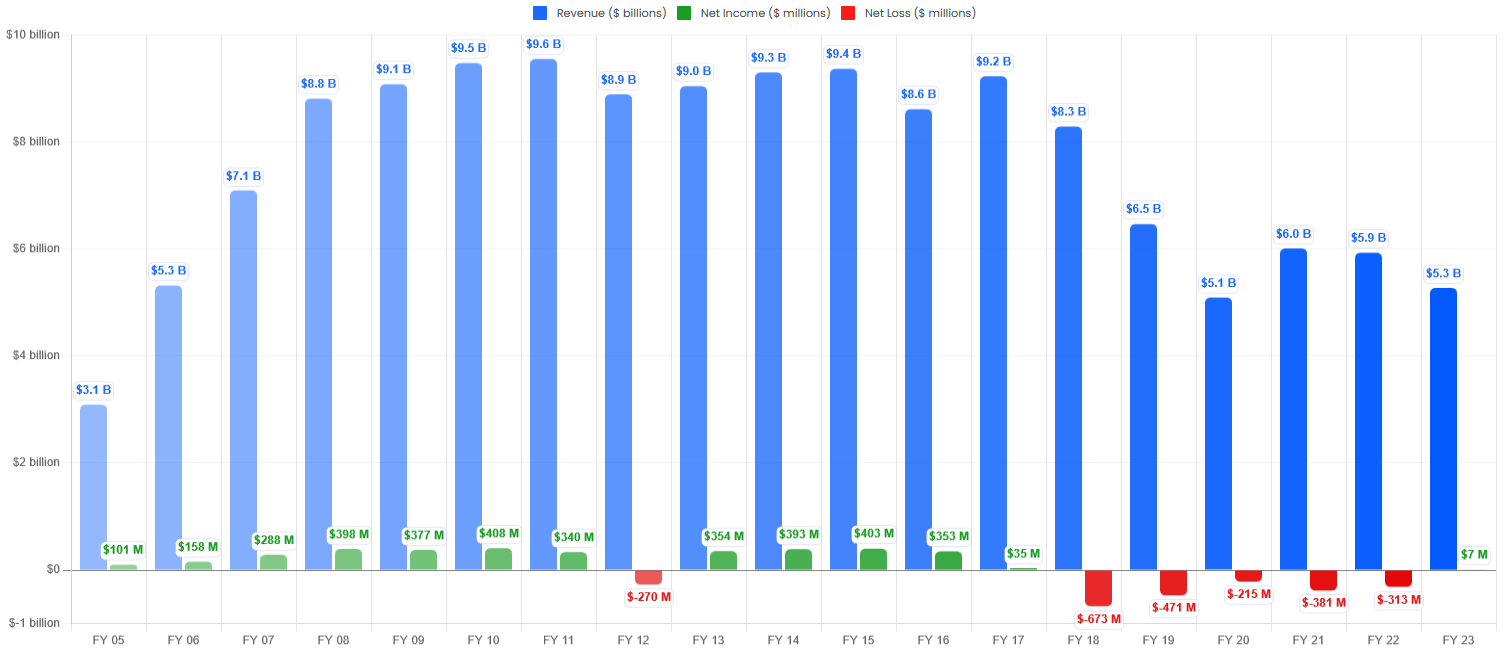

View the status and history of GameStop revenue, net earnings, stockholders' equity, and related information

As of fiscal year 2024 results, GameStop had revenue of $3.8 billion, and net income of $131 million.

As of Q3 2025 results, GameStop has been net profitable for 6 consecutive quarters.

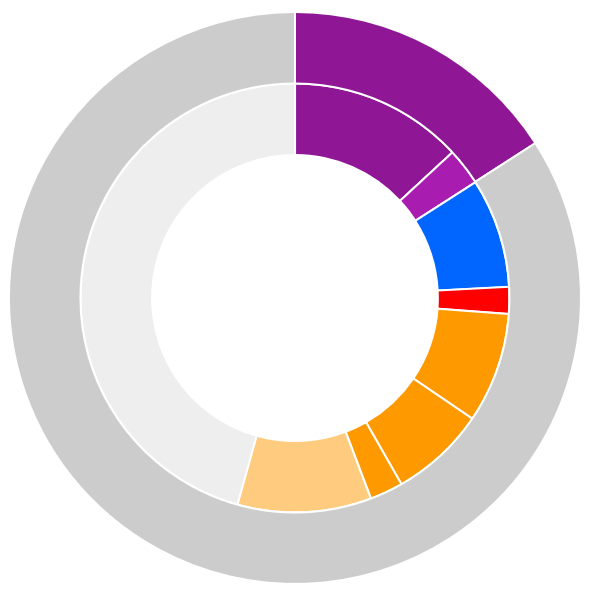

Who owns GameStop?

See a breakdown of the shares held by registered shareholders, Ryan Cohen and insiders, Keith Gill, and institutions

As a publicly traded company, GameStop is unusual because a significant portion of all issued shares are owned by registered shareholders.

As the legacy business contracts, GameStop is evolving into a capital allocator with a growing focus on strategic investments.

GameStop has raised over $4 billion through private offerings of convertible senior notes, and has used some of that money to buy 4,710 bitcoin.

Connect with the GME shareholder community across numerous platforms

About gmewiki.org