DRS versus DSPP

Both are forms of registered shares, only DRS provides self-custody

- All shares held with GameStop's transfer agent Computershare are considered "registered", which means that the individual investor is listed by name on the issuer's (GameStop's) stock register (also referred to as the "ledger") and the investor is therefore known to the company.

- However, of registered shares, DRS is the only form that provides both ownership and possession of shares

- Having shares in Computershare's Direct Stock Purchase Plan (DSPP) provides registered ownership but not possession of shares

GameStop reports the number of shares that are held by all registered holders in their 10-Q / 10-K filings.

For example, in the most recent 10Q:

... approximately 66.7 million shares (or approximately 15% of our outstanding shares) were held by registered holders with our transfer agent, Computershare Limited

This number reported by GameStop includes all registered shares held by registered holders with GameStop's transfer agent Computershare.

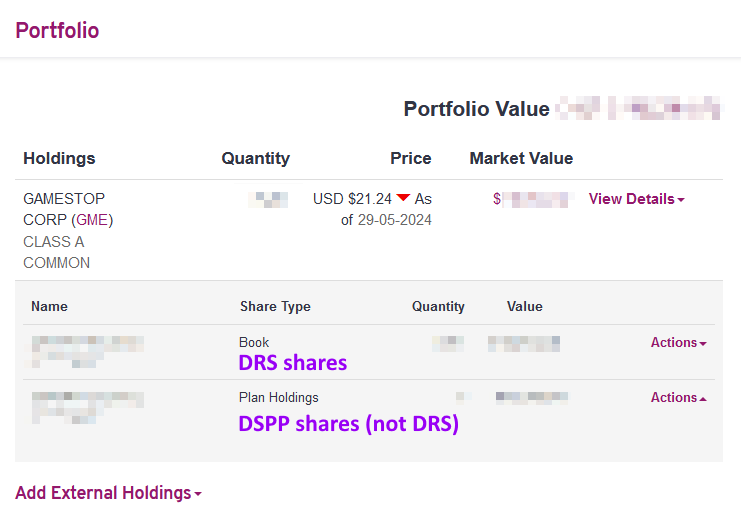

Within an account at Computershare, shareholders can hold their shares in one of two ways:

- Directly, in DRS form, with the shares listed as type 'Book'

- In Computershare's plan service, often referred to as direct stock purchase plan or DSPP, with the shares listed as type 'Plan Holdings'

When a GME investor requests to their stock broker to move the shares of GME that they paid for from their stock broker account into DRS form, the stock broker will initiate the transfer, and this will eventually place the shares into DRS form listed as 'Book' in the Computershare account.

When a GME investor purchases shares of GME directly from Computershare, this will place those purchased shares in Computershare's plan, and the shares will be shown under 'Plan Holdings' in the Computershare account.

A shareholder is easily able to move shares from plan holdings into DRS form within their Computershare account by terminating their DirectStock Plan.

- DRS

- The investor is directly registered by name as the owner of the shares in the main class on GameStop's stock ledger (or register)

- Though the shares are accessed and managed in an account with Computershare, the shares are formally "held" directly by the shareholder without any intermediary

- Holding shares in DRS form provides both ownership and possession of shares

- Holding shares in DRS form is the only way to have both ownership and possession of shares

- DSPP

- Computershare provides a plan service, commonly referred to as DSPP / direct stock purchase plan

- Shares in the plan are not held by the investor

- Typically 80% to 90% of the shares are held by Dingo & Co (Computershare's nominee)

- Typically 10% to 20% of the shares are held by Cede & Co for operational efficiency

- The investor is registered by name as the beneficial owner of the shares in a subclass on the ledger

- Holding shares in the plan provides beneficial ownership but not possession of the shares