GME DRS Timeline

Timeline of relevant events pertaining to the relationship between GME shareholders and DRS

- In the aftermath of the GME sneeze of January 2021, GME investors began to search for information to help make sense of what really happened and how the market actually functions

- Gathering largely on Reddit, several communities emerged, for example superstonk, where GME was the central topic of conversation

- Through a series of discoveries and conversations, GME investors eventually learned that DRS was the only way that an investor can obtain real ownership of the shares they paid for by putting the registered ownership of the shares in their own name

- GME shareholders advocating for DRS have faced resistance and censorship on Reddit

"Reddit will raise up to $700 million in a fundraising round led by Fidelity Management."

"[Reddit] said it had already raised $410 million from Fidelity in its second funding round since the start of the year when small-time traders gathered on its platform in their battle against Wall Street institutions. The traders, initially focused on Reddit's WallStreetBets forum but now spread across discussion boards, have changed how Wall Street analysts operate, causing major losses for some funds and powering huge gains in the shares of companies including GameStop (GME), and AMC."

As a significant investor/owner of Reddit, this gives Fidelity access to valuable data from Reddit as well as influence into Reddit. Reddit eventually began to make executive decisions in Fidelity's interests, and against the interest of GME shareholders and against DRS.

Evidence exists that shows that at least 1 moderator of superstonk was a former employee of Fidelity.

GME shareholders that had requested their shares be moved to DRS started obtaining access to their account with Computershare, and would post screenshots of their holdings with Computershare, demonstrating their successful move to DRS.

Up until this point, DRS was something that many GME shareholders on social media were still skeptical of. When GameStop reported the numbers in their 10-Q filing, this was a demonstration to GME shareholders that putting their shares in DRS was a worthwhile endeavour, something that the company itself cared about enough to provide data about it.

Not too long afterwards, one of the cofounders of the website, who was a regular and well-liked member of superstonk, is banned from that subreddit without justification by the unaccountable moderators there, and subsequently starts a new subreddit at r/DRSyourGME

"The whole post seemed padded out to get to the one punchline of making the meme stock investor look like a neckbeard loser. "

This image could only possibly refer to registered shareholders of GME. The image says "meme stock guy", but GME shareholders are the only shareholders that have used the purple circle to represent their position.

This tweet was posted shortly after The Wall Street Journal published an article titled: GameStop’s Ryan Cohen Wants to Be More Than a Meme-Stock King.

Regardless of what Ryan Cohen specifically intended by this, to many GME shareholders, "Book King" has been interpreted as a message possibly pertaining to DRS versus DSPP.

Up until this point, the DRS versus DSPP distinction was something that GME shareholders were not widely aware of. It was generally assumed, incorrectly, that if shares are with an account through Computershare, then those shares were necessarily DRS shares.

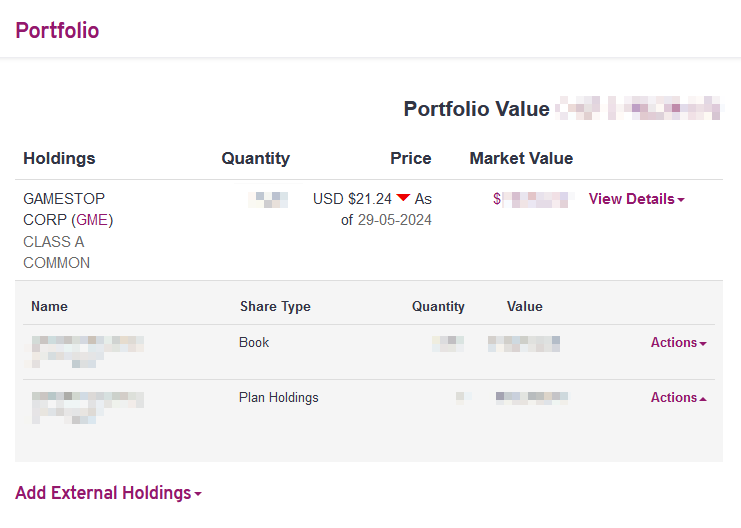

If a shareholder ever held any shares under "Plan Holdings" in their Computershare account, it would look something like this:

Shareholders are presented with two different share types, labelled as "Book", and "Plan Holdings". This is confusing and ambiguous because "Book" is understood to mean "book-entry", which just means electronically recorded shares. However, since both "Book" share type and "Plan Holdings" share type are by definition book-entry shares, the labelling does not properly distinguish the difference between these share types.

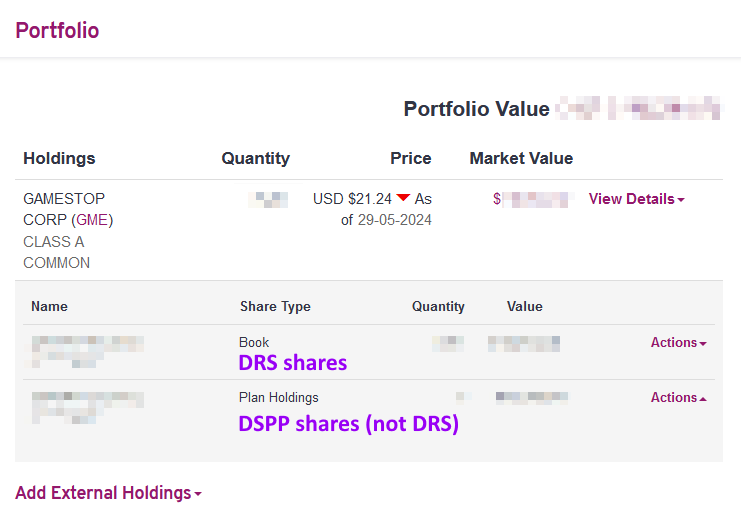

If Computershare's choice of labels were more accurate, what shareholders would be presented with would look more like this:

When Ryan Cohen became The Book King 👑, many GME shareholders in places like r/superstonk believed that Ryan Cohen was possibly making an endorsement of holding shares in DRS, aka "Book", and not DSPP, aka "Plan".

GME shareholders began to discuss the differences between the two disctinct types of holding, with the general consensus being that holding shares under "Book" share type in their Computershare account was the way.

Curiously, in the weeks and months following The Book King message, these conversations slowly started disappearing from superstonk. The moderators there started spamming their own template messages into these conversations that were unnecessarily long and confusing, used out-of-date and ambiguous information, and in general were against the community consensus, suggesting that Plan Holdings were maybe even preferrable to holding in type Book.

The moderators there started restricting these conversations entirely.

Eventually, by around February 2023, the "Book versus Plan" conversations as they were inaccurately referred to at the time, disappeared almost entirely from superstonk.

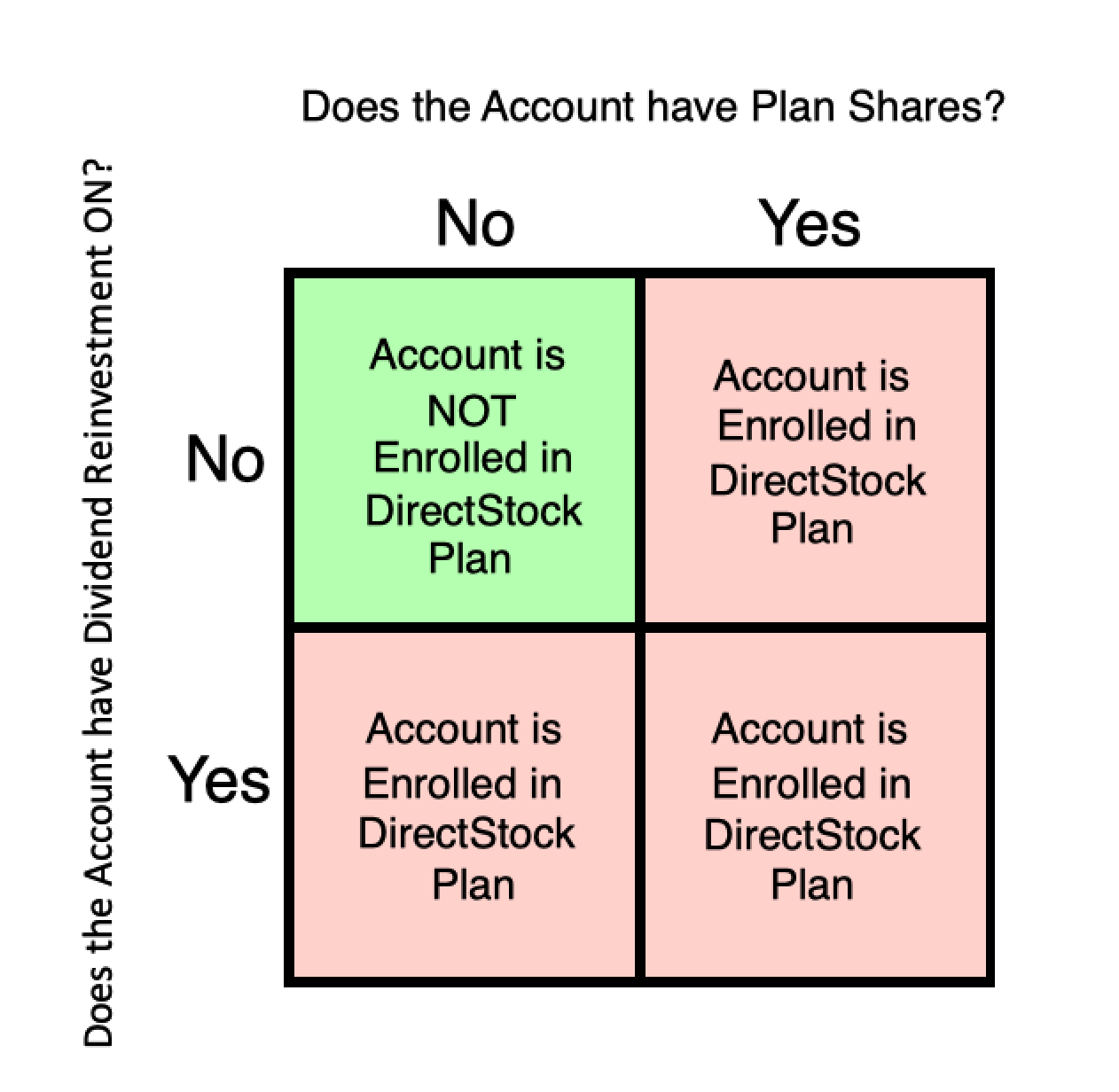

This post contained newly found information which demonstrated that holding any shares in DSPP exposes all DRS holdings to DSPP, and that to ensure all holdings are DRS, a shareholder must terminate DSPP.

Some shareholders attempted to post this information in r/superstonk, but for some reason, the mods of that subreddit evidently felt that this was not a subject of conversation that GME shareholders should be allowed to talk about, and deliberately censored all attempts at sharing the post.

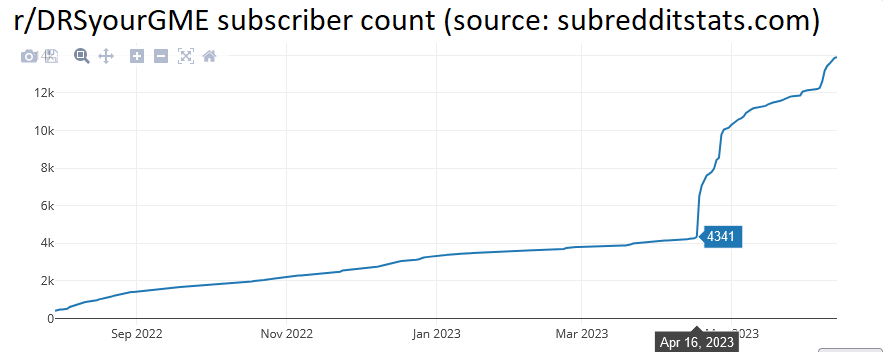

This caused anger among GME shareholders against the moderators of r/superstonk, and created a Streissand effect for the r/DRSyourGME subreddit, causing the subscriber count of that subreddit to explode, more than tripling in size in the following weeks.

Many GME shareholders were fed up with the censorship in superstonk, and were happy to find a new subreddit where the DRS versus DSPP distinction was allowed to be discussed openly.

This post preceded another popular post by the same OP a few days later which eventually became known as the "heat lamp theory," a hypothesis that DSPP shares held for "operational efficiency" at DTC is determined by a variable such as trading volume, and that there is abnormally high trading volume on DRS record dates.

"Speculate all you want. Bring forth information. Discuss. Peer review. But don’t attack the mod team, Computershare, or most importantly, each other, for discussion(s) around ideas."

"There are many communities on Reddit and on the Internet as a whole that do not have any peer review standards. If you have read this message, and it makes you even more frustrated than when you started, you might feel more comfortable on a subreddit without any review standards that allow baseless accusations and speculation without proof which masquerade as fact. That’s not what we do here."

The viewing of the stockholder list was approved and accomodated by GameStop.

While the stockholder list shows real names and home addresses and share counts of all registered shareholders, GameStop vetted all handwritten notes that were taken to ensure no personally identifying information was recorded.

Those that viewed the stockholder list subsequently shared their data in the r/DRSyourGME subreddit, which included information about DRS versus DSPP share counts.

Among the conversations about this on r/DRSyourGME, there were questions and discussions about who all was on the list. For example, was Roaring Kitty, whose real name is well known, on the stockholder list? No, his name was not on the list.

The existence or non-existence of a registered GME position was asked and discussed of other prominent community members as well. It was these discussions specifically which were used to accuse this subreddit of inappropriate (and illegal) behavior.

As of June 1, 2023, there were approximately 304,751,243 shares of our Class A common stock outstanding. Of those outstanding shares, approximately 228.1 million were held by Cede & Co on behalf of the Depository Trust & Clearing Corporation (or approximately 75% of our outstanding shares) and approximately 76.6 million shares of our Class A common stock were held by registered holders with our transfer agent (or approximately 25% of our outstanding shares) as of June 1, 2023.

Q1 2023 DRS update (24.14%)"I hope whoever shared information from a shareholder ledger on Reddit knows they violated a Federal Regulation."

Reacting to the recent viewing of the stockholder list and leaning fully into Susanne Trimbath's false accusation that something illegal had happened, the lead superstonk moderator makes a post denouncing recent actions of the r/DRSyourGME community.

The post untruthfully stated that "The personal financial information... of members of our mod team, Superstonk, and other GME communities was posted by another sub on Reddit."

"To those who released this information, this was profoundly stupid."

The team behind that subreddit sets up a new shop with a Discord server and their own Lemmy instance. Some GME shareholders from this community begin to use these alternative platforms as well as X. Eventually, the Lemmy server was shut down in 2025 due to lack of use, and the Discord server has become the primary location of this community.